Halal Pharmaceutical Market

In 2021, Halal Pharmaceuticals reached a market potential of $100 billion, which is the amount of money spent by Muslim consumers on pharmaceutical products. Investments in the industry have increased dramatically from $156 million in 2019-2021 to $2 billion in 2021-2022.

Here at Halal Pharmacore we regularly monitor the halal pharmaceutical market for any updates and developments, which could potentially create new opportunities for companies to expand their reach and access new markets.

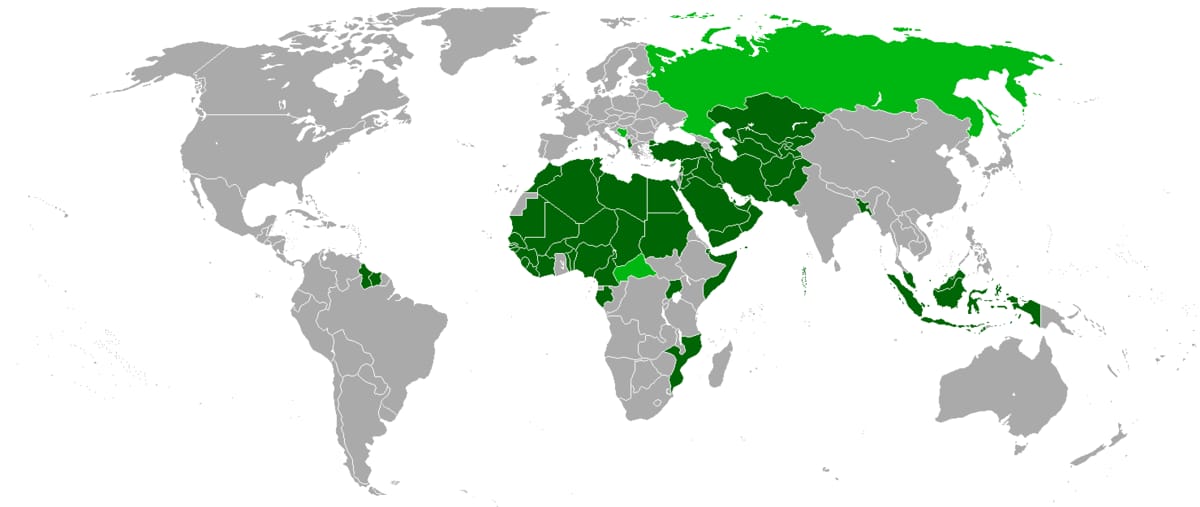

Active Halal Pharmaceutical Markets

Malaysia

Malaysia is a leader in the halal pharmaceuticals industry and was the first to set the standards for Halal Pharmaceutical Certification. It also has a vibrant market in this sector.

Indonesia

Indonesia has the largest muslim population in the world. It has a very active halal pharmaceutical market with its government being the fastest to mandate halal certification for pharmaceutical products.

Turkey

Turkey has a very large pharmaceutical muslim consumer market and is leading government harmonization efforts for Halal pharmaceutical.

United Arab Emirates

UAE is 4th largest importer of Pharmaceuticals in the OIC and has been found to have the best developed ecosystem for producing halal pharmaceuticals in terms of supply drivers, governance, awareness and pricing index according to the most recent State of Global Islamic Economy report.

Saudi Arabia

Saudi Arabia tops the list of OIC importers of pharmaceuticals, has a very large Muslim population and given its recent activities, Saudi Arabia is poised to play a major role in Halal Pharmaceuticals.

Iran

Given its large muslim population with a pharmaceutical sector worth $3.7 BN in 2020, in addition to its high interest in becoming the halal hub in the region, Iran presents opportunities for a growing halal pharmaceutical market.